The Safer Alternative to Beneficiary Addition: Use UPI to Verify Before You Pay

In this article, I talk about how to cross-verify the account holder's name using the Bank Account ID and IFSC code.

Imagine this: you received the following message from your friend or a relative and need to transfer money to them.

Account ID: 123456789012

IFSC Code: SBIN0005943

Amount: 10000Bank Account ID and IFSC Code sample

Assuming that there's no fraud activity involved, you want to transfer the money.

What would you do?

The majority of us will add this account as a Beneficiary and proceed to transfer money. This is the age-old approach, and our minds are tuned to follow these instructions if we see IFSC code and Bank Account ID.

One of the major drawbacks of this method is that we do not know the account holder's name. There's no way to cross-verify if we are transferring to the right person (What if your friend has sent the wrong account number by mistake?)

There's a workaround for this, which is popularly known as the Penny Test. You transfer 1 INR(One Rupee)to the account holder and verify if the other person received the amount. If received, then you will transfer the whole amount.

This is a hassle if the other person is a company or an organisation. Who will you reach out to confirm if the payment is received or not?

How do you solve this problem?

Hint: UPI.

When we think of UPI, we think only of the phone number and UPI ID. Did you know that we can transfer to a bank account using UPI?

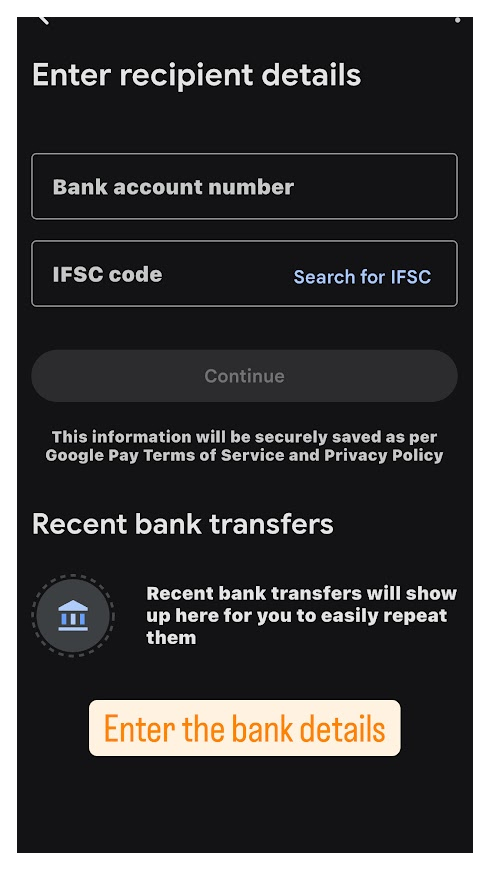

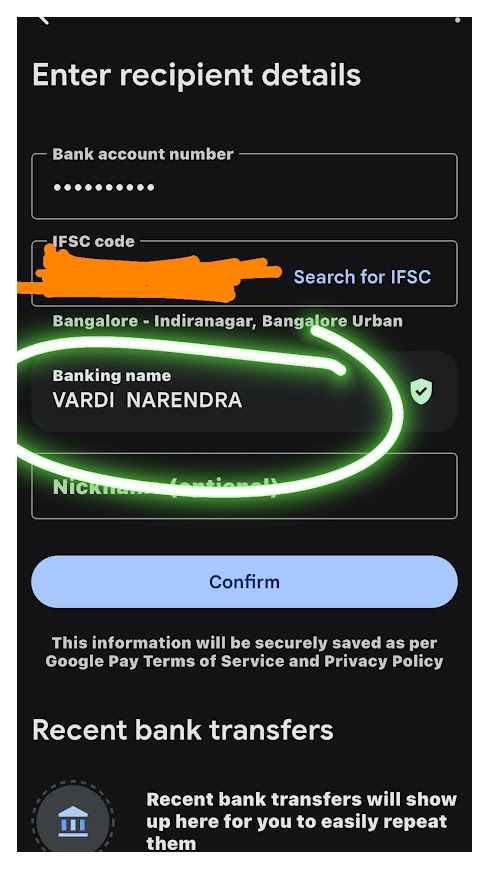

When you enter bank account details for transferring via a UPI app, it will get the account name holder's name and show it to us, which helps us to cross-verify.

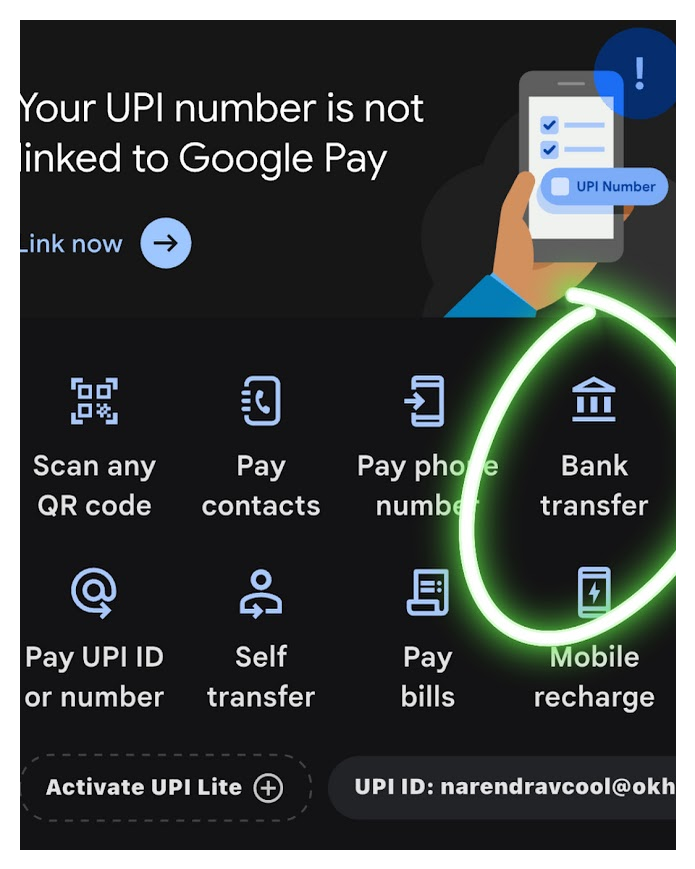

Here are the detailed steps for the Google Pay app.

Similar steps are applicable in other apps as well.

ICICI Bank even charges (as of 2025, 99 INR) for cross-verification of the account. Clever way to make money, isn't it 😉